Q&A: what to ask for when buying a used car?

- What Steps Can I Take to Ensure the Car's Condition Through Inspection?

- What are the Main Indicators of Wear and Tear I Should be Aware of?

- What Impact Does Mileage Have on the Value and Performance of the Car?

- What Inquiries Should I Make Regarding the Car's Maintenance History?

- How Can I Establish a Reasonable Price for the Pre-Owned Vehicle?

- Which Legal Documents Are Essential When Purchasing a Pre-Owned Vehicle?

- What are the Available Financing Choices for Pre-Owned Vehicles?

- What Warning Signs Should I Watch Out for During a Test Drive?

- How Can I Determine My Affordability?

- Is My Credit Score Significant?

- The Bottom Line

Buying a pre-owned vehicle can be an exciting venture, offering the opportunity to own a quality car without the hefty price tag of a brand-new model. However, it's crucial to approach this process with careful consideration and thorough investigation. One of the key aspects is questions to ask when buying a used car to ensure you're making a wise investment.

In this article, we'll explore some essential questions to ask about a used car, empowering you to make an informed decision and drive away with confidence.

What Steps Can I Take to Ensure the Car's Condition Through Inspection?

Ensuring the condition of a used car through inspection is crucial for making an informed purchasing decision. Here are car buying tips to inspect it thoroughly:

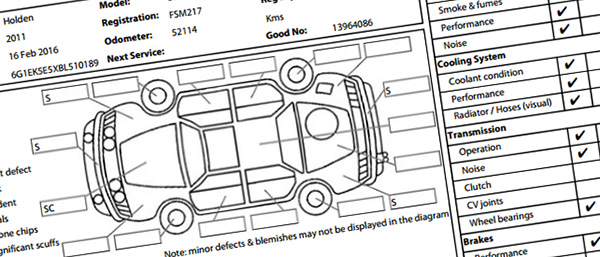

- Visual Inspection: Start with a thorough visual examination of both the car's interior and exterior.

- Check Under the Hood: Inspect the hood and inspect the engine bay for leaks, corrosion, or worn-out components.

- Inspect the Tires: Examine the tires for wear patterns, uneven tread wear, and signs of damage.

- Test Drive: Go for a test drive to evaluate the car's handling and overall performance.

- Check Electrical Components: Test all electrical components such as lights, turn signals, windshield wipers, power windows, locks, and the stereo system.

- Inspect Underneath the Car: If possible, raise the car on a lift or use a jack to inspect the underside.

- Review Maintenance Records: Ask the seller for maintenance records and review them carefully.

What are the Main Indicators of Wear and Tear I Should be Aware of?

Recognizing the main indicators of wear and tear is essential when inspecting a pre-owned car. For example, uneven wear patterns on the tires can indicate alignment issues, suspension problems, or improper tire inflation. Additionally, inspect the brake pads and discs for their condition. Squealing or grinding noises when braking, pulsation or vibration in the brake pedal, or a longer-than-usual stopping distance can all indicate worn brake components.

Look for signs of fluid leaks underneath the car or in the engine bay. Common fluid leaks include oil, coolant, transmission, and brake. Leaks can indicate deteriorating seals, gaskets, or other components.

Listen for clunking or knocking noises when going over bumps or uneven surfaces, which could indicate worn suspension components such as shock absorbers, struts, or bushings. Excessive bouncing or swaying during cornering can also indicate suspension wear.

What Impact Does Mileage Have on the Value and Performance of the Car?

Mileage is one of the most significant questions to ask before buying a used car that can affect a car's value and performance. Generally, lower mileage tends to increase the value of a vehicle, especially in the pre-owned market.

Cars with lower mileage are often perceived as having less wear and tear, potentially extending their lifespan and reducing the likelihood of major mechanical issues.

Used car prices with higher mileage may be lower than a similar model with lower mileage, reflecting the additional wear and tear and potential maintenance costs associated with higher mileage.

However, other factors such as the overall condition, maintenance history, age of the car, and market demand also play a role in determining its value. Mileage can also impact a car's performance, although its effects may vary depending on factors such as maintenance, driving habits, and the quality of the vehicle's construction.

What Inquiries Should I Make Regarding the Car's Maintenance History?

When inquiring about a car's maintenance history, gathering comprehensive information is essential to assess how well the vehicle has been cared for over time. Ask the seller or previous owner if the car has undergone regularly scheduled maintenance according to the manufacturer's recommendations. This includes oil changes, fluid flushes (such as coolant, transmission fluid, brake fluid), filter replacements, and other routine servicing.

Request any available service records, invoices, or receipts documenting past maintenance and repairs. Review these records to verify that the recommended maintenance intervals have been followed and to identify any major repairs or replacements that have been performed.

How Can I Establish a Reasonable Price for the Pre-Owned Vehicle?

Begin by researching market prices for the year, trim level, make and model of the vehicle you're interested in. Use online resources such as automotive websites, classified ads, and dealership listings to compare prices for similar vehicles in your area.

Take into account the mileage and condition of cars for sale. Inspect the car's exterior, interior, mechanical components, and overall condition. Consider factors such as the presence of any dents, scratches, rust, or mechanical issues. Any defects or required repairs should be reflected in the price.

Which Legal Documents Are Essential When Purchasing a Pre-Owned Vehicle?

When buying a used car, the vehicle title is essential as it proves ownership and lists key details like VIN, make, model, year, and owner's info. Ensure the title has no liens. The bill of sale, documenting the sale's details and both parties' signatures, is crucial for registration and recording the ownership transfer. The registration document, from the DMV, proves state registration, showing the car's info, owner's details, and registration expiry.

What are the Available Financing Choices for Pre-Owned Vehicles?

Among car loan questions and answers, there are questions about financing options available for purchasing pre-owned vehicles. Here are some of them:

- Bank Loans: Banks offer car loans for both new and used vehicles. These loans typically come with fixed interest rates and loan terms ranging from a few years to several years.

- Credit Union Loans: Credit unions often offer competitive rates on auto loans for their members. Credit union loans can have fixed interest rates and flexible terms like bank loans.

- Dealer Financing: Many car dealerships offer financing options for pre-owned vehicles through partnerships with banks or financing companies. The interest rates and terms of these loans can differ.

- Online Lenders: Numerous online lenders specialize in auto loans, including loans for used cars. These lenders may offer competitive rates and convenient application processes.

What Warning Signs Should I Watch Out for During a Test Drive?

Paying close attention to the vehicle's performance, handling, and overall condition is essential. Listen for any unusual sounds, such as grinding, squealing, rattling, or clunking noises, which could indicate issues with the engine, transmission, suspension, or brakes.

Excessive vibration felt through the steering wheel, pedals, or seats may indicate problems with the tires, suspension, or drivetrain. If the vehicle pulls to one side while driving straight or feels unstable or difficult to control, there may be issues with the alignment, suspension, or steering components.

How Can I Determine My Affordability?

Determining your affordability when purchasing a pre-owned vehicle involves assessing your financial situation and budget to ensure you can comfortably afford the costs associated with car ownership. Calculate your monthly income from all sources, including wages, salaries, bonuses, and any additional income such as investments or rental properties.

Consider any debts you're currently paying off, such as student loans, credit card debt, or personal loans. Consider how much you can afford to allocate towards a car payment while managing your debt responsibly.

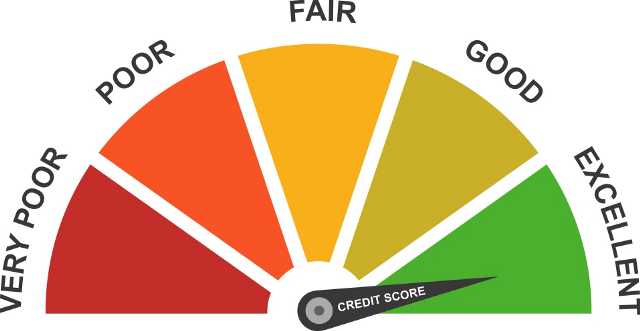

Is My Credit Score Significant?

Of course, your credit score is significant when determining your ability to obtain financing for a pre-owned vehicle and the terms of that financing. Credit scores are utilized by lenders to evaluate the risk associated with loaning you funds. A higher credit score indicates that you're more likely to repay the loan on time, making you a lower-risk borrower. Having a lower credit score could lead to challenges in securing a loan or necessitate paying higher interest rates.

In addition, your credit score directly impacts the interest rate you'll be offered on an auto loan. Generally, borrowers with higher credit scores qualify for lower interest rates, while those with lower credit scores may face higher rates. Over the life of the loan, even a small difference in interest rates can significantly affect the total amount of interest paid.

The Bottom Line

Knowing what to ask for when buying a used car allows you to gather essential information to make an informed decision. Conduct thorough research, obtain vehicle history reports, and consider professional inspections to mitigate risks and ensure a satisfying purchase experience. With due diligence and attention to detail, you can confidently navigate buying a pre-owned vehicle and drive away with peace of mind.

This article is a set of legal notes from RollsAuto.com, an automotive website that strived to help customers find used vehicles, provide a financial center, payment calculator, etc.

These articles on the website are for educational and informational purposes only. The material in the article is distributed without profit to further propagate this information, which is appreciated and helps readers understand car selling more effectively.

The view in the article does not necessarily reflect the author's opinion. This site is not liable for the potential damages, lost profits, or any other losses of any kind caused by your reliance on the information in this article.

RollsAuto.com is only the author of these articles and is not in any way affiliated with the manufacturer or service provider mentioned. All trademarks are property of their respective owners and are mentioned as examples. Privacy and Terms policy: www.rollsauto.com/privacy-policy