The Best Auto Loan Rates 2022 For You

- Our Advice For You - a Loan Calculator

- Types Of Auto Loans

- How To Apply for an Auto Loan

- What Is a Good Interest Rate for a Car Loan?

- How to choose the best auto loan lender

- What to know before applying for an auto loan

- Best Car Loan Rates

- FAQ

What are car loans and how do they work?

When it comes to car loan interest, even if it is not rocket science, many people misunderstand how they work. These are the crucial points connected to auto loan rates:

- Many car buyers tend to think that the total loan already includes the interest you will pay on a car. For example, if your loan is 25 thousand USD, a lot of them will think this amount of money is also the interest rate, and that is not true. Interest is going to be on top of your loan, and that is always how it works for simple loans with fixed interest rates.

- The other false assumption for many people is that the total interest that you’ll pay on the car is just by taking the interest rate and multiplying it by the total amount that you’ll borrow:

Total interest = Rate x Loan

For example, if you borrow 30 thousand USD and have an interest rate of 5% then you multiply those together and you’ll end up with 1500 USD. So, a lot of people think this 1500 USD is the total that you are going to pay as interest. No way. Interest rates are generally applied yearly. That is why you see APY (annual percentage yield) next to the interest rates. Therefore, if you have a loan for 3-5-6 years, the math will be changed enormously because as you pay down the loan, you pay less interest.

This is why you have to understand exactly how the loan works. You can do your math, see what you are going to pay and decide whether it is worth it or not.

Both new and used car loan rates are affected by three main areas:

- Borrowed Amount.

Consider how much you are actually going to borrow. Naturally, if you have a 10 thousand USD loan at even 1% interest you are going to pay more interest on a higher amount that you are borrowing.

- Interest Rate.

The Interest Rate itself means that if we are talking of zero interest - that is great, you are not going to pay any interest. But if we are talking of 2% interest vs 10%, that will have a huge swing on how much interest you are going to pay during the loan life cycle. Especially if you borrowed a ton of money and you have a really long car loan.

- The Length Of A Loan.

This last one is probably the most influential here. If you have a 3-year car loan, you are actually going to have a higher monthly payment than a 5-year loan but you are going to pay a lot less in bank interest because it is two years shorter. The interest works this way - you start at the top, you slowly pay down the loan, and you are only paying interest on what you owe. So, if you can pay that off faster, then you are naturally going to pay a lot less in interest.

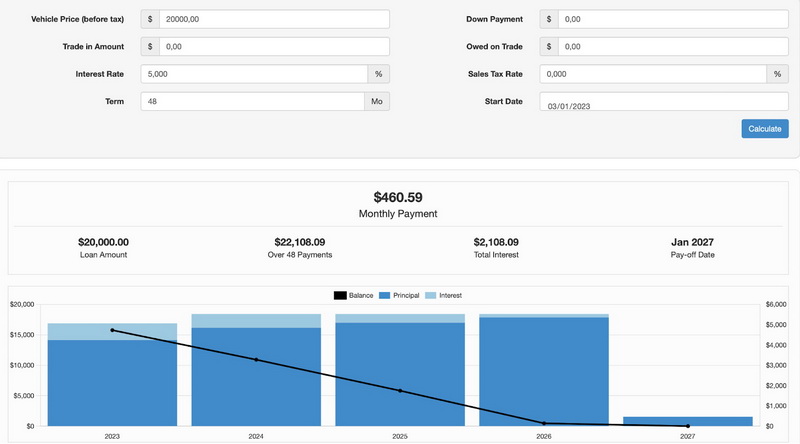

Imagine you found a car and after taxes, fees, downpayment, etc you end up financing 20 thousand USD. Your credits are fine, you have got a 5% interest rate deal, and you want to finance the car for 48 months, or 4 years with a bit more than 460 USD monthly payment. And then there is the total interest you are going to pay for the life cycle of your loan - the entire 4 years - which will be a bit more than 2100 USD. So, all in all, you will have to pay a bit more than 22 thousand USD.

Let us see now where did these numbers come from?

Our Advice For You - a Loan Calculator

Nothing fancy. Loan calculator. You can find it both in AppStore and Google Play. Plugging in the basic numbers will create a realistic picture of your financial situation and whether you can cope with financing the car you are passionate about.

Here is what it looks like:

Image 1. An example of an Auto Loan Calculator

You can see here that, according to the payment schedule, the more you pay down your loan, the less interest you have to pay.

The beauty of the loan payment calculator is in the ability to see the breakdown of your monthly payments, even if you don't know all of the inputs yet. Not every field applies to you, so you can leave it blank as it was.

If you want to speed up the process, here is an advice. Trying to pay over the principal every single month. That way the balance is going down even faster, and you are going to pay less and less interest over the life of your loan. Paying the loan earlier is a total win.

Using the Calculator is great before signing a contract but you can also benefit from it by checking your existing car loan. If you do your investigation and see that the interest rates you are currently paying are too high and irrelevant, that is the reason to refinance your car. Because the percentage of the interest rate makes the world of difference if we take the same car.

Yet, refinancing your car deal to a lower interest rate means you have a good credit score in your bank. Local credit unions are probably the best choice if it comes to finding low auto loan rates. You can also check on Rolls Auto Sales. They have very competitive rates for all types of auto loans.

Talking about the types…

Types Of Auto Loans

Depending on your needs there are 4 main types of auto loans.

- Purchase Loan.

Purchase loan is quite simple and clear-cut. This is the loan that you are going to get if you buy a new or used car from a dealership. As a rule, in this type of loan, you will find lower interest rates on new cars if compared to used cars.

- Private-Party Loan.

Many lenders do not offer them because private-party financing is considered to be riskier than a standard purchase loan. You’ll seek out a private party loan when buying a vehicle from a private seller.

- Lease Buy-Out Loan

These come with a fixed amount of monthly payments and typically will last from 12 to 36 months. Drivers return lease vehicles at the end of the term unless they decide to purchase them afterward with a lease buy-out loan.

- Refinancing Loan.

These agreements alter your current loan, usually the term or the car loan rates. When you decide to refinance, you get a lower monthly payment. This type also includes a Cash-Out Refinancing Loan that allows you to borrow more money by accessing the equity of your vehicle.

How To Apply for an Auto Loan

The application process has become quite easy nowadays. You can even fill out a loan application in the comfort of your home instead of doing it in a dealership or a bank. The other part of your homework is answering the most important question about how much you are ready to pay. Remember about insurance, maintenance, and gas expenses.

There are a few common types of auto lending institutions.

- Traditional banks keep being popular choices because of their competitive rates and the discounts given to customers who already have their accounts or other lines of credit.

- Credit unions, or member-owned organizations, meanwhile, are similar to banks but they often have less strict lending requirements and lower interest rates. It is usually easier to join a credit union with either a nominal fee or a charity donation.

- Dealerships are one of the most common places to secure a car loan. In-house financing options are prevalent at car dealerships and you might find lower auto financing rates from dealers than banks. Larger dealerships sometimes extend extremely low APR offers to people with excellent credits. It is worth noting though that auto dealers add unnecessary extra payments.

- In the case of Online lenders, you will find a great variety of options. Some of them are from direct lenders with the backing of large financial institutions.

So, the first step when applying for an auto loan is (1) DEFINING THE BUDGET. A payment calculator is a great help for you here, it enables you to see the real picture of your financial situation and whether you cope with payments month by month.

Once you know how much you can borrow, (2) CHECK YOUR CREDIT SCORE. The better it is the better rates you will be offered by your dealership. Do not get upset if it is less than perfect, we are in 2023 where dealers are extremely interested to get new buyers.

Do your investigation, compare, and (3) CHOOSE THE BEST OFFER. Prequalification and preapproval are very helpful for a better understanding of all the eligibility, and give the foundation and confidence for effective negotiations. Take your time studying the potential option carefully. No rush is good here, the investment of time and effort will reward you with the best choice.

Then comes the time to (4) MAKE SURE YOUR DOCUMENTATION IS WELL-ARRANGED. Even if requirements vary from one dealership to another, prepare the most important ones like paycheck stubs, residential papers, and your current driver’s license.

Now you are ready to (5) SUBMIT YOUR APPLICATION. Either online or in person, this step will give you the feeling of joyous fulfillment, once the choice is made, and you did your “homework” well.

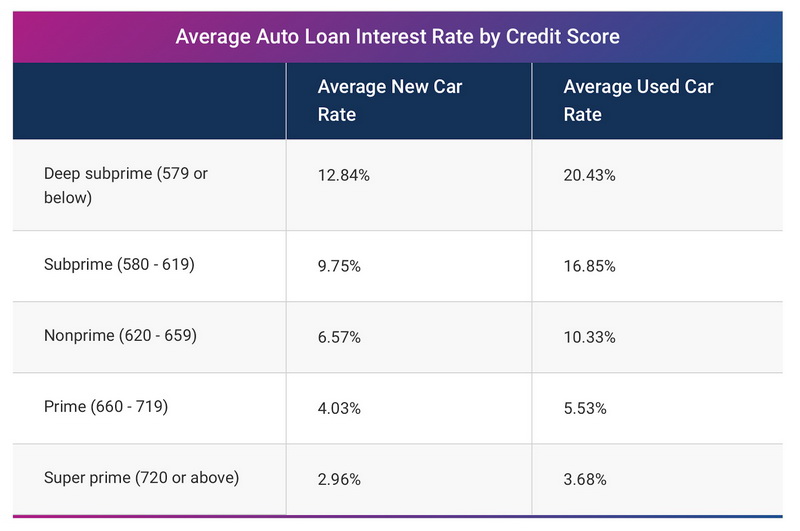

What Is a Good Interest Rate for a Car Loan?

According to Experian Information Solutions, the average auto loan interest rate at the end of 2022 was 5.16% for new cars and 9.34% for used cars.

The 780+ credit score allowed drivers the best chance to get a rate below 4% for new cars.

A few months earlier the numbers were the following:

Image 2. The second quarter of 2022 statistics.

Consumers Credit Union, PenFed Credit Union, USAA, LightStream, and others have proved to be the best for January 2023. Here you can see the whole list with numbers:

Image 3. Current Best Auto Loan Ratings (Source https://www.forbes.com/advisor/auto-loans/best-auto-loan-rates/)

How to choose the best auto loan lender

Each lender will have its disadvantages and downsides. That is why you have to study and explore every possible option.

The ForbesAdvisor’s top picks for credit unions and online lenders for January 2023 you can check here.

What to know before applying for an auto loan

Auto loans can range from 12 to 84 months. Ideally, you do not want to go any longer than 60 months or 5 years. The low payments of a 72 or 84 months loan can be inviting but you will be paying on your vehicle beyond its best years and you can quickly end up underwater in your new car meaning that you will owe more than what it’s worth.

If you do a lot of driving like a long way to work every day, avoid a 72 or 84 months loan. Miles of your car have the potential to end up quickly.

Understanding the loan terminology will help you a lot. For example, interest rates and APRs are often used interchangeably but there are subtle differences between them.

Interest rates are the actual percentage a lender charges you to borrow money.

APRs include the base interest rate but also factor in any additional fees.

Due to this distinction, you get a more accurate measure of how much you will actually pay by looking at APR.

Auto loans have different interest rates depending on the borrower and the lender. Although there are a few things to consider like federal interest rates and overall market conditions. The type of vehicle you are buying is also of great importance. The newer your car is the better interest you are going to pay. Cars with higher mileage on the contrary.

Your debt-to-income (DTI) ratio will show the percentage of your monthly debt payments compared to your monthly gross income. A DTI ratio of 43% or higher is believed risky by lenders, and there are huge doubts you will get an auto loan.

Talking about your negotiation power, you should also understand the difference between being pre-approved vs pre-qualified. Many people use these terms interchangeably. Yet, the little difference between them is quite important. A pre-qualification is what happens whenever you submit an application online and you answer the question about your income and debts, etc. the lender is looking at this information, entrusting what you said, and making a judgment decision based on the provided info. They are going to ask you for a lot of documents, do not be afraid of that, as this is kind of one step further in any car loaning process. You will receive a pre-approval letter saying how much you can qualify for in terms of a car loan.

Best Car Loan Rates

Apart from doing your investigation and rates comparisons from various lenders and doing your best at raising your credit score, here is a plan you can follow to get the best outcome for your budget:

- Make the life of your loan shorter. This way, you reduce the burden of auto lenders’ risk, so they are more relaxed and offer lower APRs vs. long-term choices. As we have already mentioned, higher monthly payments in this case also mean considerable savings at the end of the day.

- Increase your down payment. Although not an affordable option for everyone, making a bigger down payment ends up in lower APRs.

- Autopay. Many lenders encourage using automatic payment systems by offering rate discounts.

- Preapproval. Think about applying for preapproval, it is better than prequalification. This way you get solid offers from lenders with great APRs.

- Co-signer. Your friend or a family member has an excellent credit score while you are not proud of yours at all. It is not a crime to ask him/her to co-sign on your loan. All you need is confidence in being able to cover your monthly payments.

Conclusion

All in all, on your journey to the most relevant auto finance rates that will fit your budget perfectly, do your investigation first and study multiple offers from different places. You can find the best options through the various places we have mentioned here. You should also keep in mind many aspects that influence your auto loan terms and various tactics and strategies for you to get the most favorable rates for your budget.

We hope our post was supportive and encouraging for you. We do believe you will find the best auto loan! Good luck!

FAQ

Can I negotiate my rate on an auto loan?

Yes, you can, and you should. Get the necessary preparations first. Documents in order, a clear vision of your credit, and a bank pre-approval letter are great.

What credit score do I need to buy a car?

In general, the minimum score you will need is 661 or higher.

How can I get a 0% APR on a car loan?

Zero percent financing offers are meant for clients with perfect credit — 800 and above, as a rule.

When is the best time to buy a car?

This is very individual but, usually, late May is good for nice offers as well as the end of the year.

This article is a set of legal notes from RollsAuto.com, an automotive website that strived to help customers find used vehicles, provide a financial center, payment calculator, etc.

These articles on the website are for educational and informational purposes only. The material in the article is distributed without profit to further propagate this information, which is appreciated and helps readers understand car selling more effectively.

The view in the article does not necessarily reflect the author's opinion. This site is not liable for the potential damages, lost profits, or any other losses of any kind caused by your reliance on the information in this article.

RollsAuto.com is only the author of these articles and is not in any way affiliated with the manufacturer or service provider mentioned. All trademarks are property of their respective owners and are mentioned as examples. Privacy and Terms policy: www.rollsauto.com/privacy-policy