Can You Lease A Used Car?

- How Does It Work? Introduction

- What Defines The Amount Of A Lease Payment?

- Used Car Leasing: Does It Actually Make Sense?

- Benefits Of Leasing A Used Car

- Choosing A Used Car Lease. Step-By-Step Guide

- Conclusion

Yes, you definitely can! Should you lease or purchase? Can you save thousands of USD by leasing a used car vs leasing a new car? Let’s find out now!

How Does It Work? Introduction

The main reason people do not lease used cars is that they do not really know how the leases work.

When you lease a vehicle, you are basically renting it from the manufacturer for a certain length of time like 36 months or three years, and a certain amount of miles a year is settled up for your driving journey. As a rule, it is between 12-15 thousand miles a year. At the end of your lease period, you can return the car to the dealer or buy it for the amount of money that was determined in the lease contract.

What Defines The Amount Of A Lease Payment?

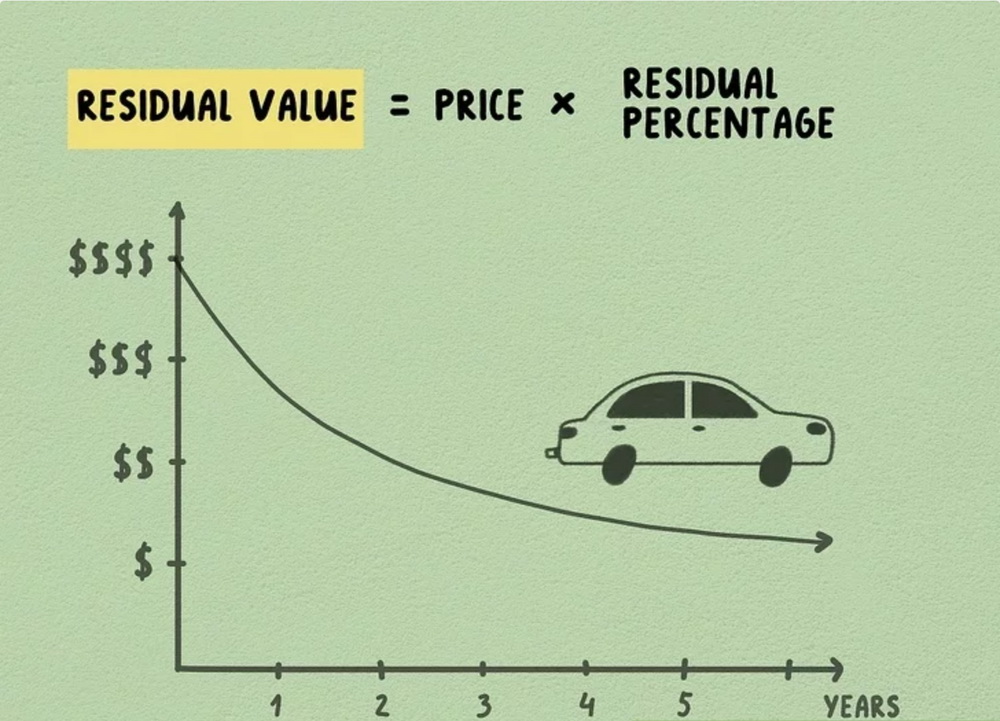

A typical piece of advice you would get these days, in 2022, is to lease rather than buy because three years from now you would be whole. But the truth is, the manufacturers have really adjusted their lease programs. They are not supporting the residuals like they had in the past. The higher the residual value, the lower the amount of depreciation that gets factored into the lease. The lower the devaluation, the less you are paying.

In addition to this, the money factors are not nearly as aggressive as they used to be. The money factor is the rent or interest on your lease. The higher the money factor, the higher the payment.

The components of a lease payment are the following:

- Depreciation. It is based on a residual value.

- Interest. It is estimated via the money factor.

- Taxes.

For example, the residual value of a 2020 Mini Cooper in Minnesota was around 65%. Experts figured that in 3 years the car would lose about 35% of its value. That’s not a lot to lose if compared to typical Toyota residuals which are up to 73%.

The purchase price, defined by the residual value, has to be described in the lease contract. If the car costs more than the residual value, it is probably a nice deal.

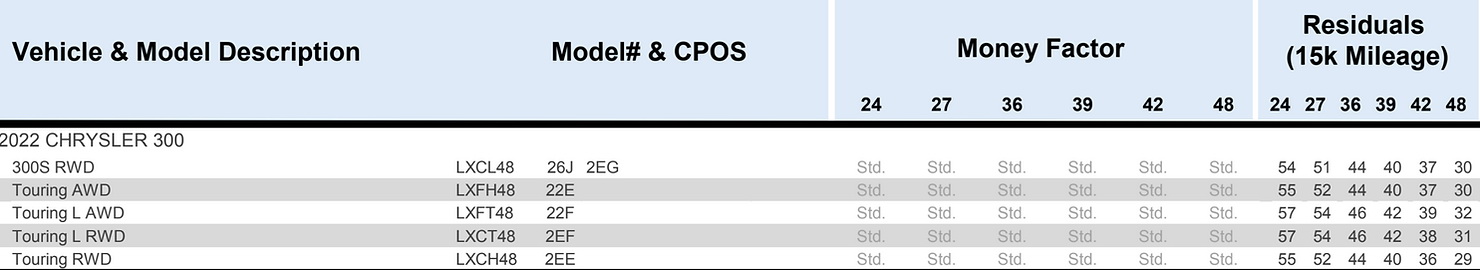

Table 1. Residual values examples (Chrysler 300)

Here you can see how the lease durations vary from 24 and up to 48 months, and the difference in residual values.

If the money factor is very low, and the way you convey a money factor into what equivalent interest rate would be. You take this money factor indicator like .00125 and you time that by 2400 and that would give you that approximate interest rate. So if money factors today are running closer to .002 than they were 3 years ago, then that’s going to inflate the payment. Money factors could be higher because interest rates are starting to go up a little bit so that factor could be neutralized.

Typically, when there is less demand and prices are crazy, it is better off the lease. Now, in 2022, if there are no aggressive programs for leasing, you are better off buying your car.

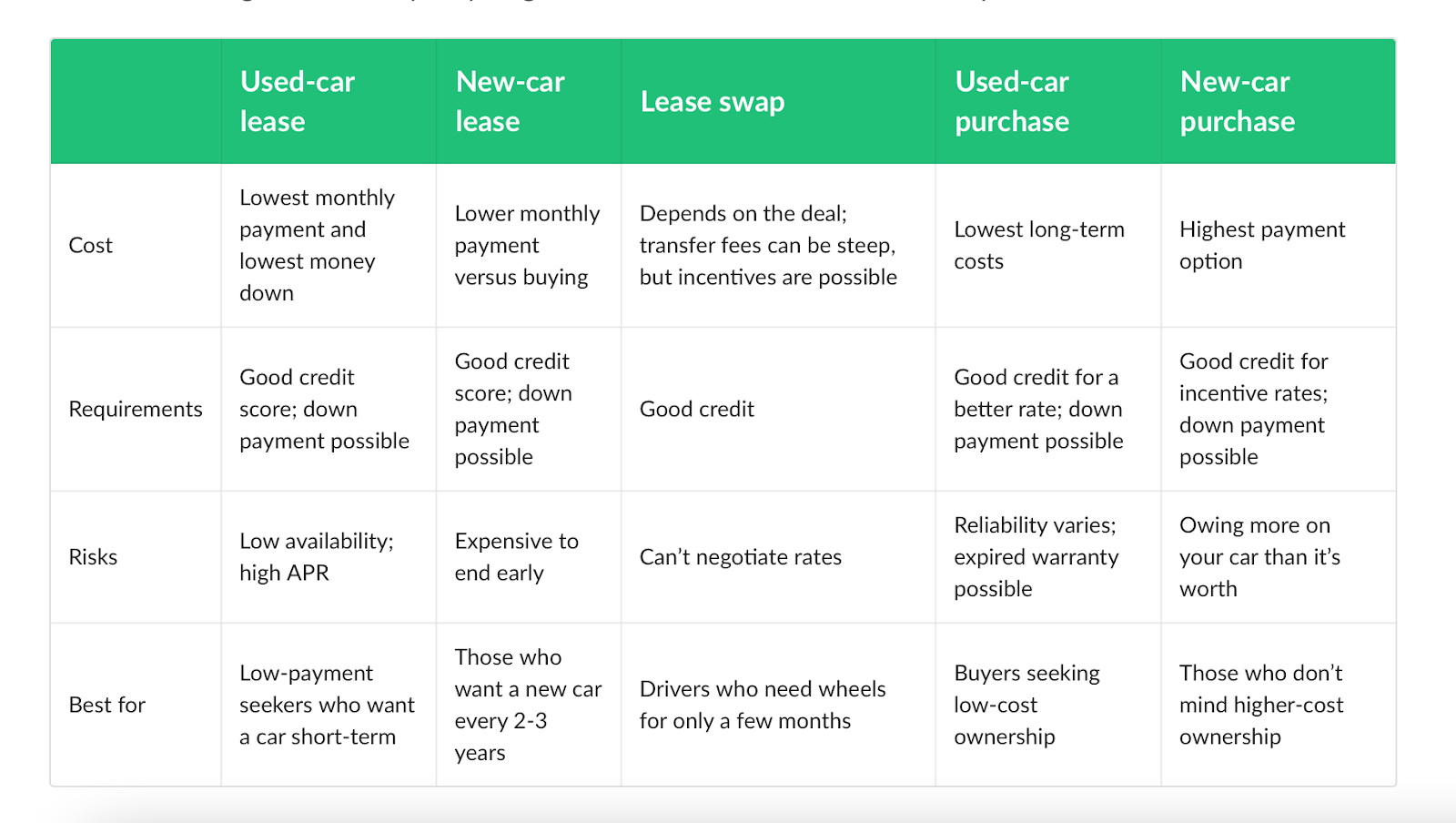

Look at the table below, it will help you to consider various options regarding the cost, financial requirements, risk, and buyers categories.

For example, if we look at the Risks, used cars have a low availability rate, while new ones may come with expired warranties, etc.

Table 2. Comparing car buying vs leasing options.

Used Car Leasing: Does It Actually Make Sense?

Leasing a used car is definitely not an option for everyone, and here is why:

- Being not that popular, used car leasing deals are not offered by many companies, and you do have to spend a lot of time looking for a deal that really makes sense compared to a new car leasing.

- Depending on the age of a used car, during the time that you’ve got the car on the lease, you may have to change tires or do some necessary tech or safety features upgrades, which leads to extra expenses. While with a new car leasing, you most likely won’t have to do that.

- Besides, used cars are associated with a higher interest rate, as a rule, or money factor for a lease, if compared to new vehicles.

- And, unfortunately, the coolest used car lease deals manufacturers offer for luxury brands.

- Plus maintenance costs, you will have to pay for everything that is worn out and is not covered by the warranty.

Anyways, it is high time we move to the brighter side and focus on the advantages.

Benefits Of Leasing A Used Car

Table 3. Leasing a care benefits

As you can see from the image above, while leasing a used car you can benefit a lot.

- Saving your budget: In the case of a used car lease, we talk of lower payments compared to leasing or purchasing a new one.

- Being able to afford a car of higher class: By leasing an older model, you can get a cooler car or better features than the latest model leasing.

- More extended warranty: A CPO car is protected by a warranty from the manufacturer, this is not an option for other used cars.

Choosing A Used Car Lease. Step-By-Step Guide

The key aspects in the process of used car leasing are dealers’ offers, negotiations, warranty, extra requirements, and personal responsibility. Make sure you do not miss out on any of them.

- Looking for a dealer’s offer. Contacting a local dealer comes first, or the financing office of the car brand you’re considering to check its availability. As we have already mentioned above, you won’t probably find tons of nice offers, but still, it is worth trying.

- Negotiation. It is not a crime to discuss and work out a used lease deal details. The price of the car, to begin with, and then step in the down payment sum, mileage limits, and other important options like taxes, different kinds of additional fees, etc.

- Warranty. Together with the original manufacturer’s warranty, the extended warranty may be also provided by the dealer. That means more expenses up to 2500 USD even if extra protection is always good. Just check both documents in case there is some unnecessary overlapping coverage. Investigate extended warranty sources - apart from care dealers, there are also credit unions, independent companies, insurance providers, and even auto clubs.

- Be aware of the additional nuances. Your leasing provider may include GAP insurance in the contract, and it is wise to ask whether it is a part of your monthly payments or one you can get elsewhere

- Mind your duty bounds. Prior to signing the contract, double-check everything about your responsibility, sure you understand all the terms regarding mileage, early termination, excess wearing away fees, etc. Your lease deal may include extra miles purchasing, it is better than penalty charges when the lease period is over.

Conclusion

They say, once you get a great lease deal on a car, you will never go back to other purchasing options with your next vehicle again. Some people are against leasing because it is often attached to the concept of renting. The truth is, leasing makes a lot of financial sense, though it is not for everyone.

If you are thinking about a brand-spanking new car with the newest tech features and that fresh smell of new each time your lease is over expires, leasing a new car instead of a used one may be a better choice.

Then as well the fuss of mileage limits, extended warranties, and extra maintenance costs is not what you are ready for, leasing a new vehicle would suit you best. Or maybe just buying a used car.

On the other hand, used-car leasing can save you lots of money, and we hope, with our information you are more confident in finding an optimal deal for your wishes and budget. Please mind that the cost savings of leasing a used car imply future maintenance.

The decision is up to you, but make it final only after doing a nice homework: be realistic about your budget and study terms and policies for the best used-car lease choice. Good luck!

This article is a set of legal notes from RollsAuto.com, an automotive website that strived to help customers find used vehicles, provide a financial center, payment calculator, etc.

These articles on the website are for educational and informational purposes only. The material in the article is distributed without profit to further propagate this information, which is appreciated and helps readers understand car selling more effectively.

The view in the article does not necessarily reflect the author's opinion. This site is not liable for the potential damages, lost profits, or any other losses of any kind caused by your reliance on the information in this article.

RollsAuto.com is only the author of these articles and is not in any way affiliated with the manufacturer or service provider mentioned. All trademarks are property of their respective owners and are mentioned as examples. Privacy and Terms policy: www.rollsauto.com/privacy-policy